Basic Feature

BIR Accreditation

In 2011, DMS Point of Sale received its accreditation from the Bureau of Internal Revenue (BIR). So, if your business is duly registered with the BIR, obtaining the permit to use DMS POS system is a breeze.

First, decide on the type of permit that you want or need: 1) Special Purpose Machine (SPM), or 2) Cash Registry Machine (CRM). Each of these has distinct features and legal requirements.

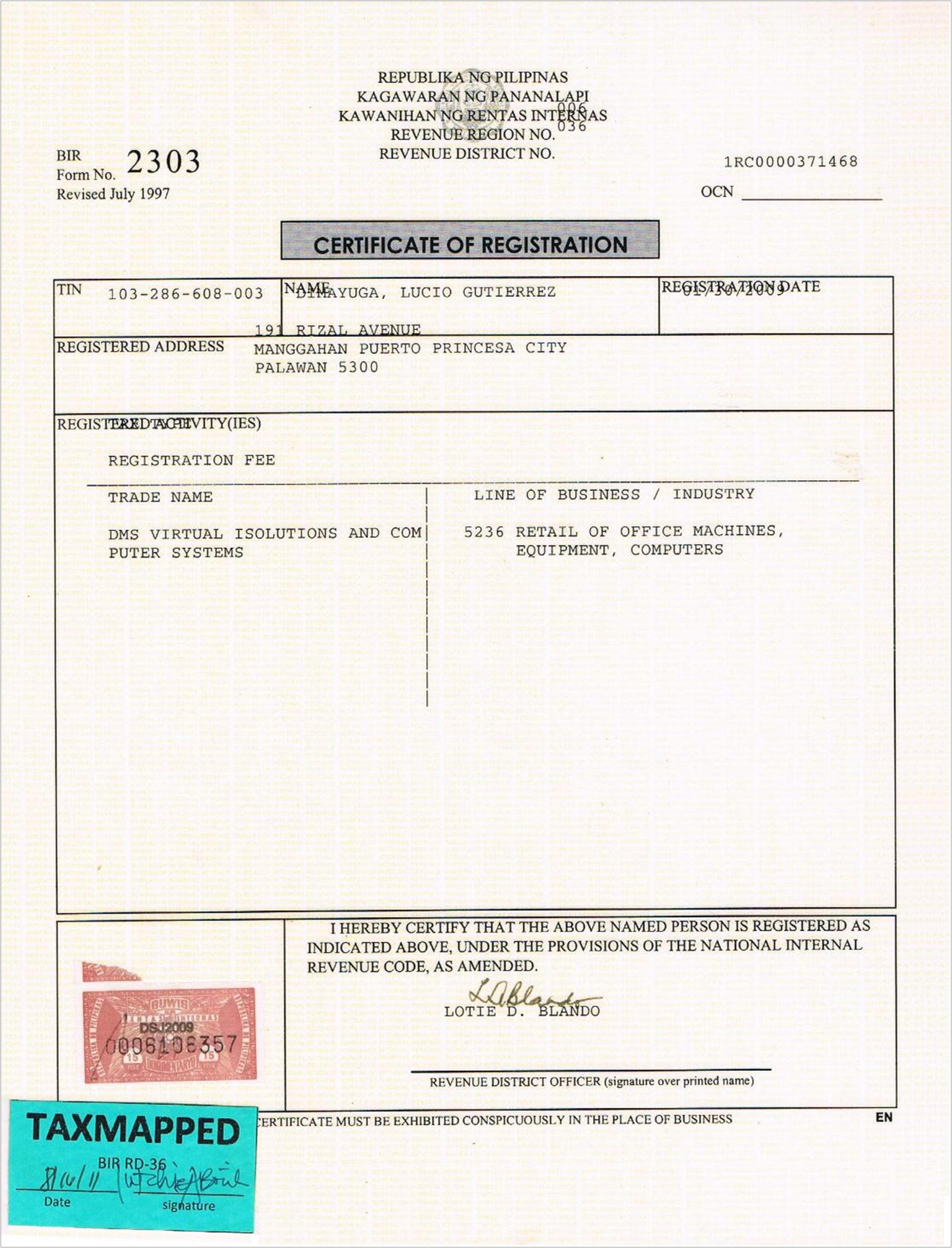

Both SPM and CRM registration require a copy of the Certificate of Registration (COR) or BIR Form 2303. This document is supposedly displayed in your place of business for public viewing.

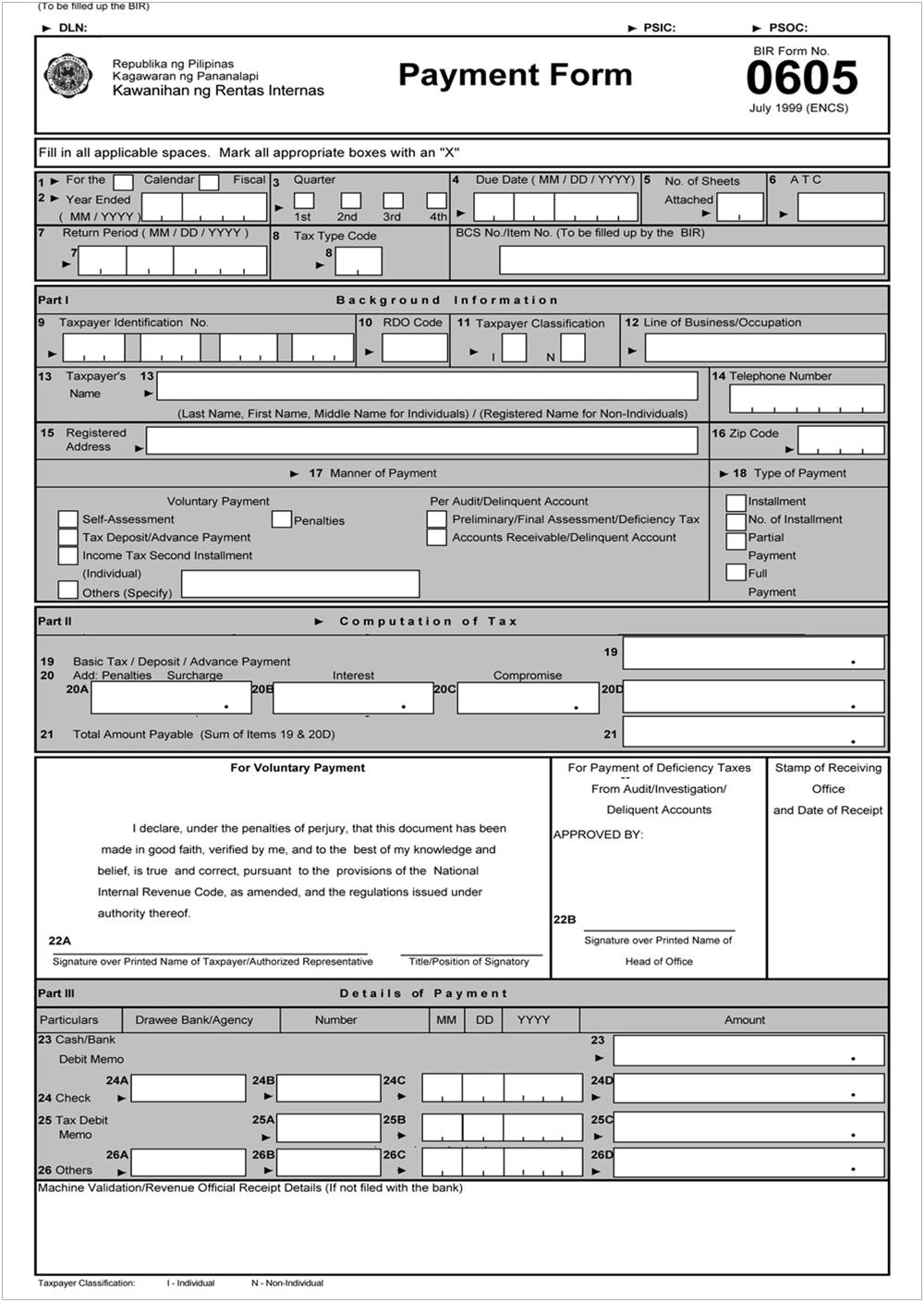

Both SPM and CRM registration require an updated payment of Annual Registration Fee (ARF) using BIR Form 0605. This is mandatory for new and old businesses, and must be paid yearly on or before January 31 of each renewal year.

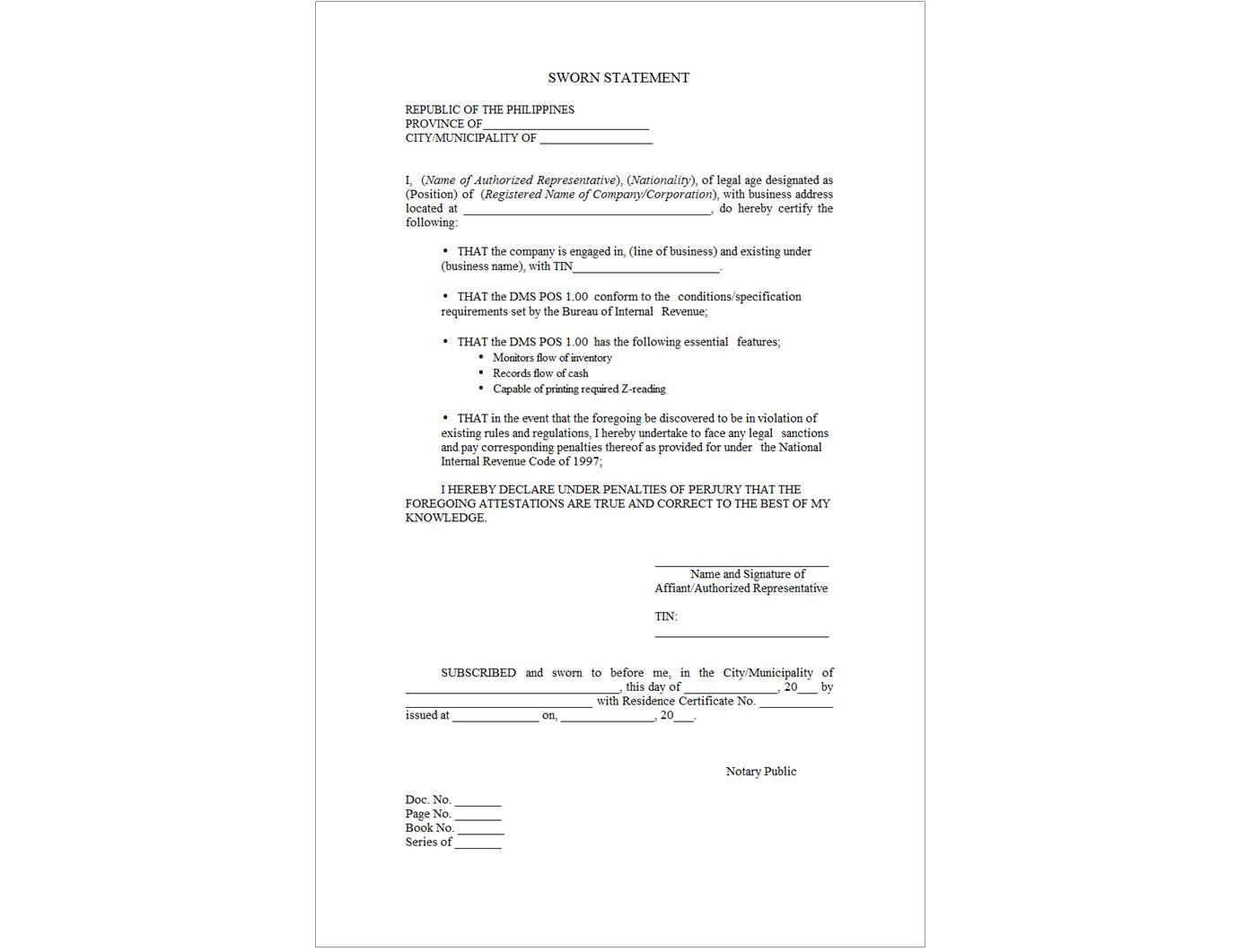

SPM registration requires a sworn statement by the business owner. CRM registration does not.

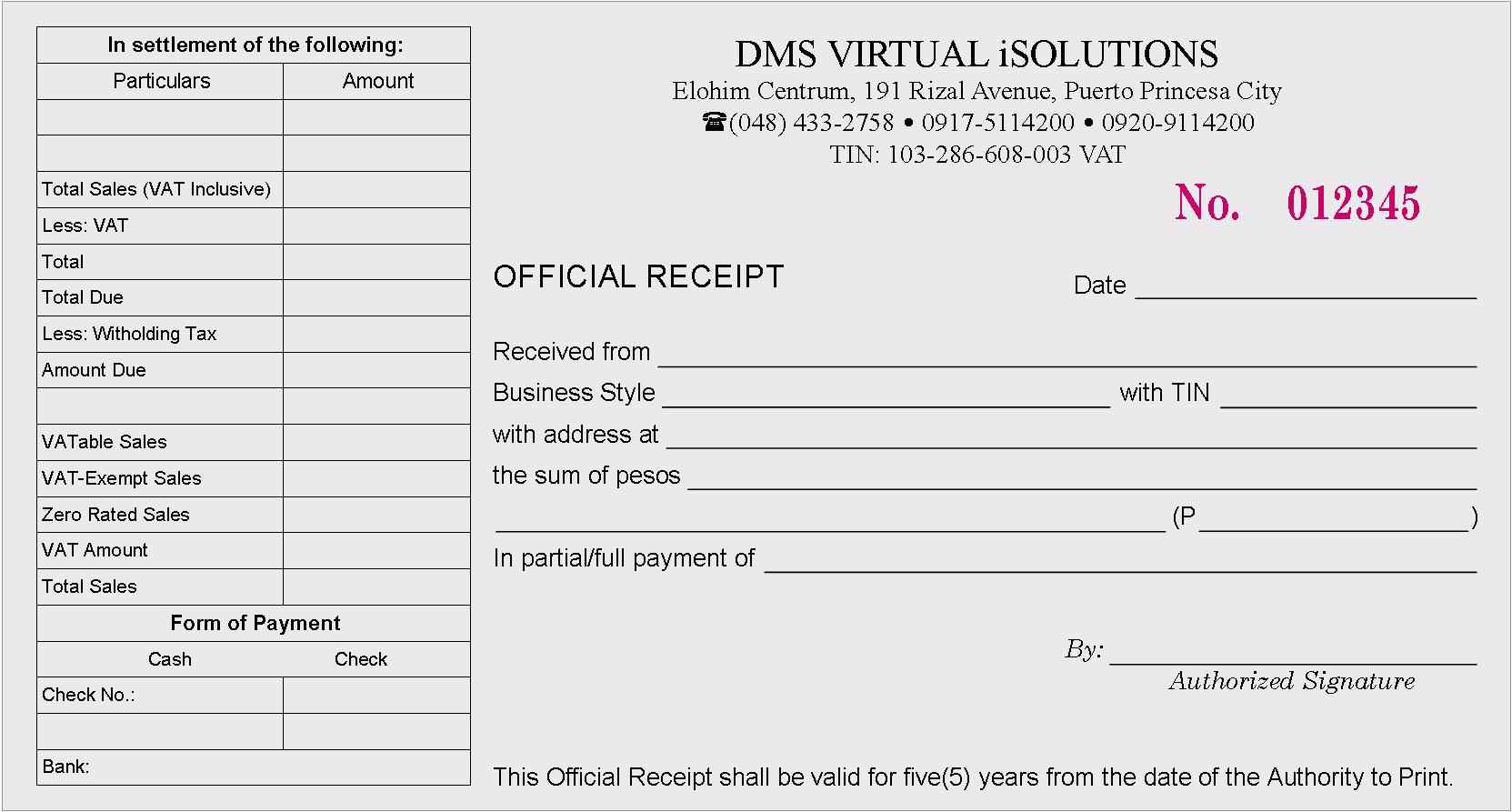

Since an SPM is not authorized to print Official Receipts, the business owner should use conventional Official Receipts to document sale transactions. CRM users should also have conventional Official Receipts to use when the CRM is non-operational.

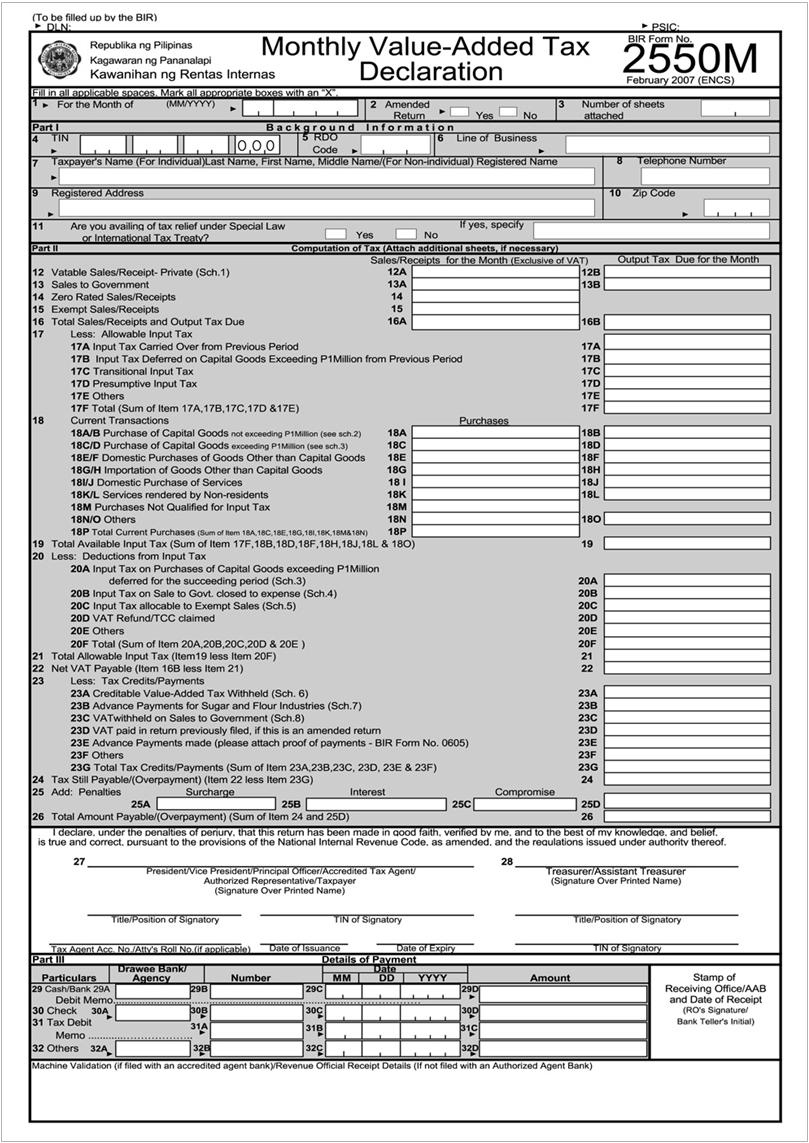

CRM users are required to print an end-of-day daily sales report (Z Reading) for each day of operation. These printouts are submitted to the BIR as attachment to the Monthly VAT Declaration (BIR Form 2550M) which is due for submission on or before the 20th day of each month.

Online Registration

SPM or CRM registration is now done online. Follow these steps:

1. Before applying for POS registration, be sure that you have enough quantity of BIR-approved Official Receipts on hand.

2. Submit to us a digital copy of your Certificate of Registration (BIR Form 2303) and BIR Form 0605 (Annual Registration Fee) for the current year. Send the documents to our email address: dms.technical@yahoo.com.

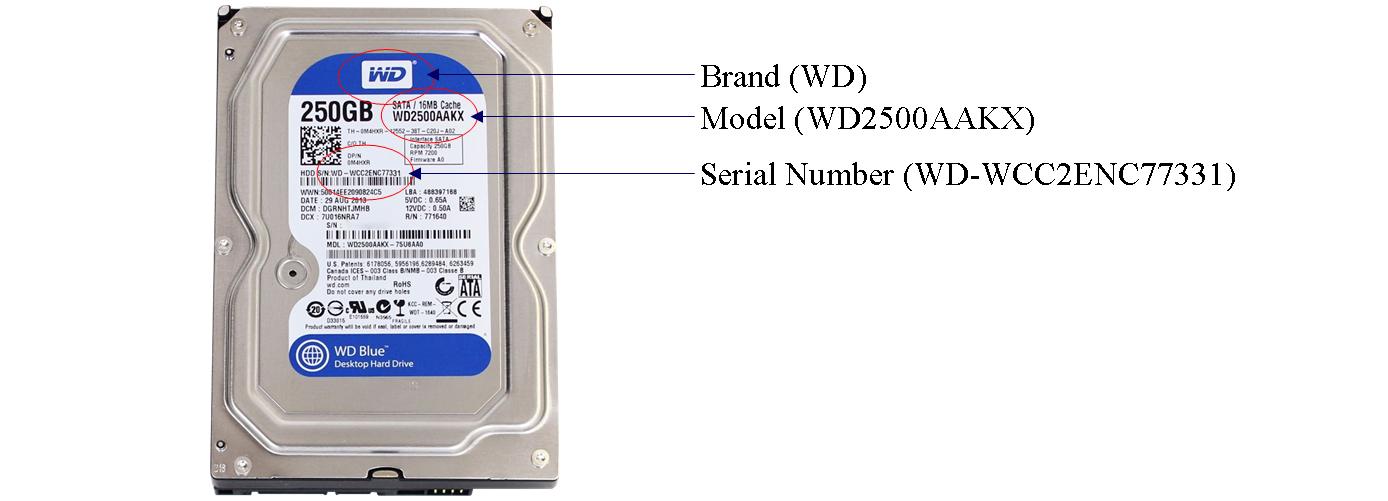

3. If you are going to provide the POS computer, provide the brand, model and serial number of the installed primary hard disk.

4. If applying for an SPM (Special Purpose Machine), prepare the required Sworn Statement. Be sure that it is duly notarized.

5. We will do the online application for the registration of your POS system with the BIR.

6. We will send to your email the BIR's confirmation of our application for registration.

7. You will be notified by the BIR's if your application for POS registration is approved or denied.

8. When your application is approved, your Revenue District Office (RDO) will notify you to get the necessary documents and for other matters.

9. Attach the document (Permit to Use) to the POS equipment where the public could easily see it.

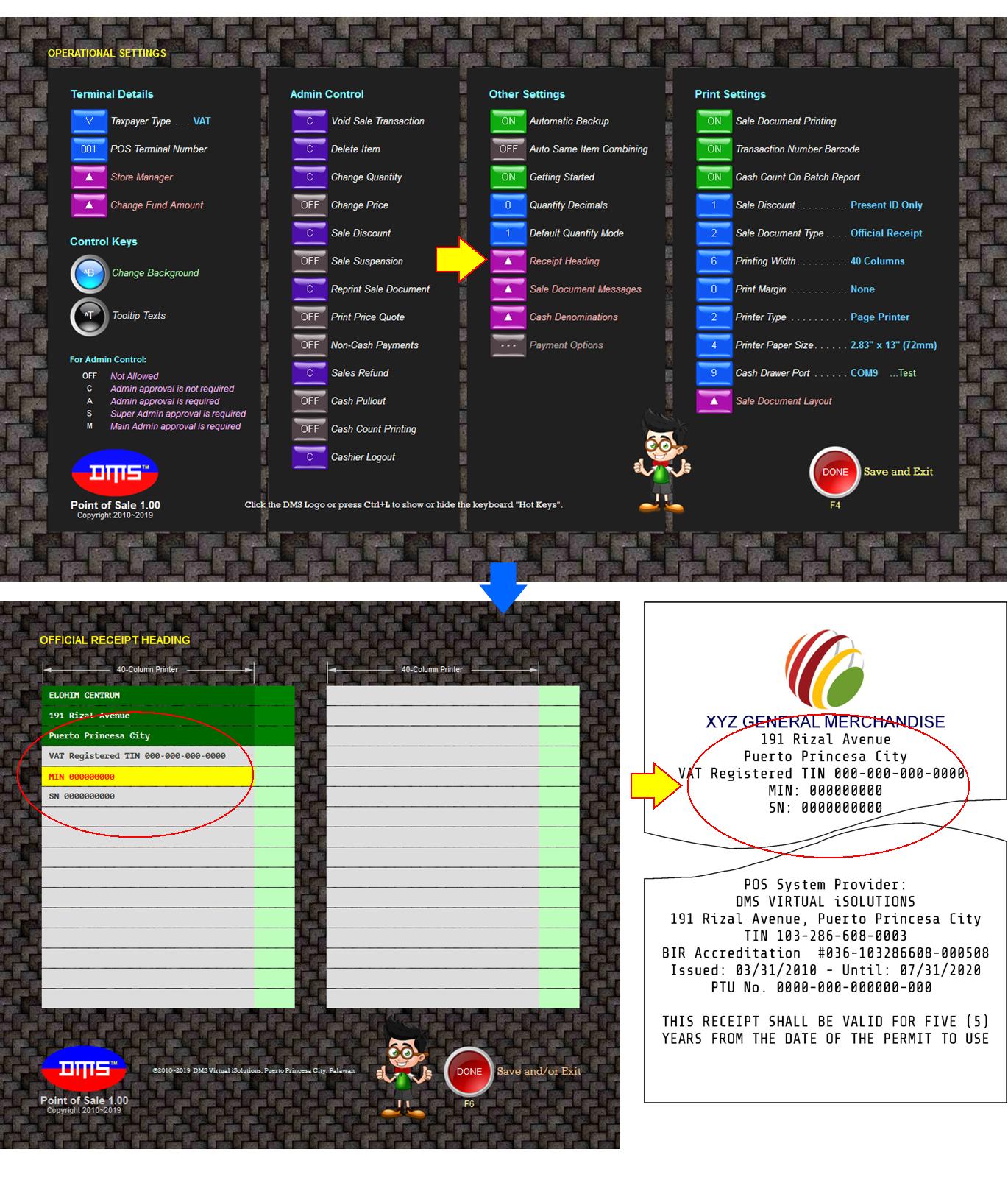

10. Update the heading of your POS Official Receipt and Z Reading with the data supplied by the BIR. If you need assistance, we will be more than happy to help.

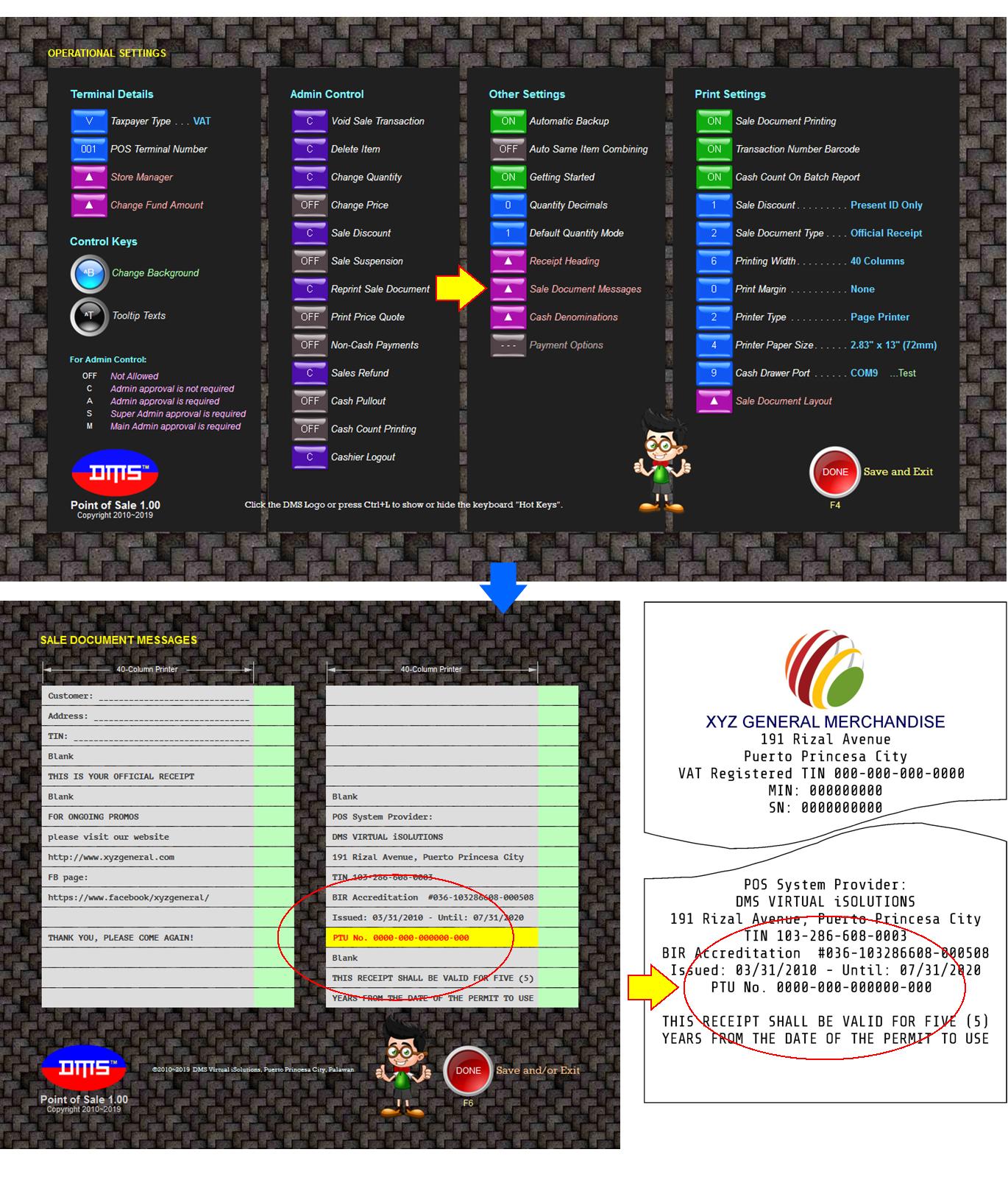

11. Update the Permit to Use (PTU) number that will be printed at the bottom portion of your Official Receipt.

If you need further assistance, please feel free to contact us. We will be more than happy to help.

©2019 DMS Virtual iSolutions, 191 Rizal Avenue, Puerto Princesa City, Palawan, Philippines